Maruti Suzuki Q2 2025 – A Positive Outlook for Investors

Maruti Suzuki Q2 Results 2025 one of India’s most trusted and influential automobile brands, is all set to announce its Q2 results for FY26 on October 31, 2025. This moment is creating a wave of excitement among investors and car enthusiasts alike. With its continued focus on innovation, product expansion, and customer satisfaction, Maruti Suzuki Q2 is expected to bring encouraging financial numbers that reflect the brand’s strong market position and consumer loyalty.

Financial experts anticipate a steady rise in the company’s performance, driven by increased sales and a notable improvement in profit margins. Despite economic pressures and fluctuating consumer demand, Maruti Suzuki continues to demonstrate remarkable resilience in the competitive automobile industry.

Maruti Suzuki Q2 2025 Preview – Steady Performance, Strong Growth

As per early projections, Maruti Suzuki’s revenue for Q2 FY26 is expected to range between ₹40,890 crore and ₹41,450 crore, showing a healthy 6.4% quarter-on-quarter (QoQ) and 9.9% year-on-year (YoY) growth. This rise signals a strong recovery and sustained consumer confidence in the brand.

The company’s Profit After Tax (PAT) is projected to grow by 20.7% YoY, while EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is expected to increase by 2.8% YoY, reaching around ₹4,538 crore. Additionally, net profit is anticipated to touch ₹3,705 crore, reflecting an increase of 2.1% YoY and 10.3% QoQ.

These numbers indicate that Maruti Suzuki is successfully balancing its cost management with growing demand, particularly in urban regions where car sales have remained strong.

Maruti Suzuki Q2 Share Performance – Confidence in the Market

Over the past six months, Maruti Suzuki’s share price has shown impressive momentum, climbing 37.40% to reach ₹16,300 per share. On a yearly scale, the stock has seen a 30% increase, reaffirming investors’ long-term faith in the company.

Even with short-term market fluctuations, Maruti Suzuki has maintained a strong five-year performance, delivering an extraordinary 136.41% return to its shareholders. As of mid-October 2025, the company’s shares continue to trade actively, with a day high of ₹16,350 per share, reflecting sustained investor optimism.

Maruti Suzuki Q2 2025 – Challenges and Key Insights

While the numbers look promising, the company continues to navigate certain economic challenges. Inflationary pressures have kept rural demand under stress, especially in price-sensitive segments. However, Maruti Suzuki has managed to maintain its stronghold through strategic pricing, diverse product lines, and expanding its footprint in the hybrid and electric vehicle segments.

Experts also believe that the company’s gradual push toward EV technology may bring long-term benefits, even as it temporarily adds cost pressures. Maruti Suzuki’s adaptive strategies, combined with its production efficiency, are likely to ensure consistent growth in the coming quarters.

Maruti Suzuki Q2 2025 – Final Thoughts

As Maruti Suzuki gears up to announce its Q2 FY26 results on October 31, 2025, expectations are high across the market. With an anticipated 9.9% YoY rise in revenue, a 20.7% jump in PAT, and a 2.8% increase in EBITDA, the outlook remains bright.

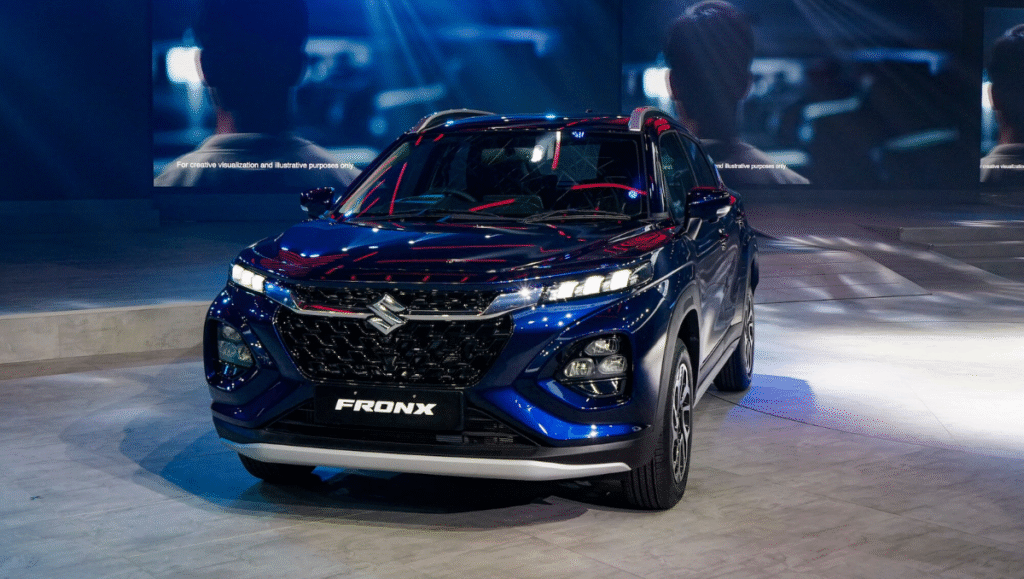

Beyond just numbers, this quarter represents Maruti Suzuki’s enduring ability to evolve, innovate, and retain the trust of millions of customers. Whether it’s expanding its SUV lineup, entering the EV race, or delivering strong financial returns, Maruti Suzuki Q2 2025 stands as a testament to the company’s strong fundamentals and long-term vision.

Disclaimer:

Investment in the stock market involves risk. The information provided in this article is for educational and informational purposes only and should not be considered financial advice. Investors are advised to conduct their own research or consult a certified financial advisor before making investment decisions.