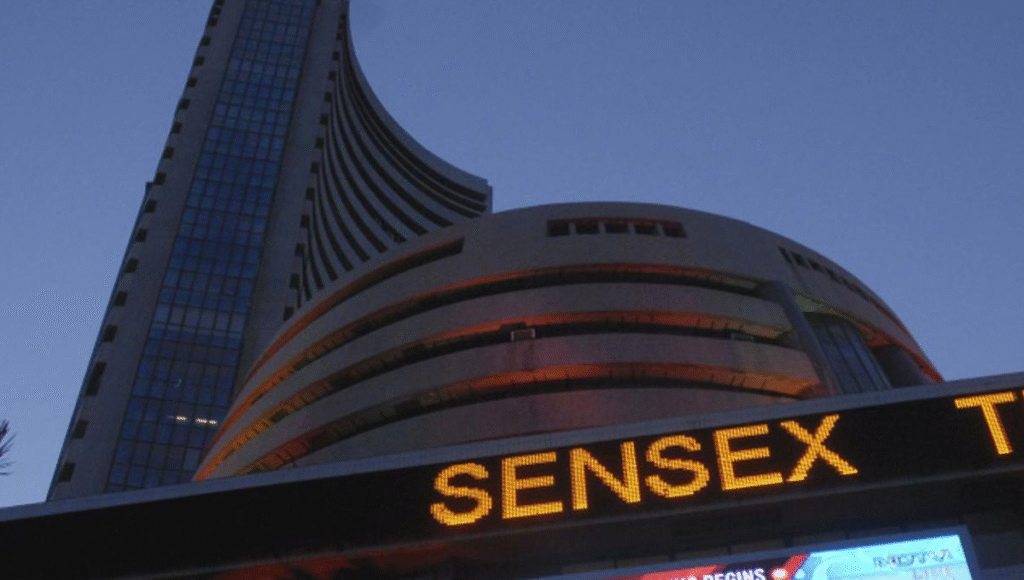

In a remarkable end to the trading week, the Sensex stock markets witnessed a powerful rally on October 17, 2025, as investor confidence and domestic momentum pushed benchmark indices to fresh record highs. The Sensex surged past the 84,000 mark, gaining over 600 points, while the Nifty climbed by 100 points, trading strongly at 25,650.

Sensex Stock Markets Shine as Indices Hit New 52-Week Highs

It was a historic Friday for Indian investors, with the Sensex stock markets recording their third consecutive day of gains. The benchmark Sensex crossed the 84,000 level for the first time in three months, marking a significant milestone and setting a new 52-week high. The Nifty followed suit, scaling fresh heights as buying interest remained strong across sectors.

Out of the 30 Sensex-listed companies, 18 stocks advanced while 12 declined. Leading the charge were Asian Paints, Mahindra & Mahindra (M&M), and Bharti Airtel, each rising by more than 1%, signaling broad-based optimism in the markets. The auto and pharma sectors also demonstrated robust strength, helping sustain the positive momentum.

Global Cues Mixed, but Sensex Stock Markets Stay Resilient

While Indian equities celebrated fresh highs, global markets painted a mixed picture. In Asia, Korea’s KOSPI was marginally higher at 3,749.44, but Japan’s Nikkei slipped 0.93% to 47,827.31. The Hang Seng Index in Hong Kong tumbled 1.51%, and China’s Shanghai Composite fell 0.99%, reflecting cautious investor sentiment overseas.

Across the Atlantic, the U.S. stock markets closed lower on October 16, with the Dow Jones dropping 0.65% to 45,952.24, the Nasdaq Composite slipping 0.47%, and the S&P 500 losing 0.63%. Despite the global weakness, Indian markets managed to sustain their upward trajectory, driven by strong domestic institutional support and continued buying interest.

FIIs Return to Buying as Domestic Investors Stay Bullish

Market data shows that Foreign Institutional Investors (FIIs) turned net buyers on October 16, purchasing shares worth ₹997.29 crore in the cash segment. Domestic Institutional Investors (DIIs) also made strong net purchases of ₹4,076.20 crore on the same day, adding fuel to the market rally.

So far in October, foreign investors have sold ₹2,890.32 crore worth of shares, while domestic investors have bought ₹26,517.84 crore, showing that local institutions continue to provide crucial market support. In contrast, September saw FIIs offload ₹35,301.36 crore, while DIIs purchased a hefty ₹65,343.59 crore, reflecting consistent domestic optimism even in periods of foreign outflows.

Sensex Stock Markets Continue to Gain Momentum

This week’s performance further builds on Thursday’s strong rally, when the Sensex closed 862 points higher at 83,468, while the Nifty jumped 262 points to end at 25,585. The steady climb over the past few sessions underscores renewed market confidence driven by easing inflation, improving corporate earnings, and a stable global outlook.

Investors and traders alike are seeing positive signals, with experts expecting the market to continue its bullish tone if domestic liquidity remains strong and global headwinds stay contained. The Sensex stock markets, it seems, are entering a new phase of strength and optimism as 2025 draws closer to its final quarter.

Disclaimer:

This article is based on publicly available market data as of October 17, 2025. Market movements are subject to change based on economic and global factors. Readers are advised to consult their financial advisors or check real-time updates before making any investment decisions.